Tenancies

The owner that leases a building gets revenues that can be taxed in two possible ways:

- Ordinary system of taxation where the tax base on which to calculate the personal income tax depends on the type of agreement:

- Fair rent where revenues subject to the personal income tax derive from the annual rental fee reduced of the 5% as a lump-sum.

- Free trade regime where revenues are given by the highest value of the difference between the land registry income (increased of the 5%) and the rental fee, reduced of the 15%.

- Conventional rent for buildings in cities with high population density, when the rent is determined on the basis of agreements between the associations of owners and tenants.

- Withholding system of taxation, is an alternative and soft system of income taxation reserved only to individuals holding ownership or other legal claims on the rented property. This taxation system is therefore not available for companies.

Those who choose the withholding must first notify the tenant by registered letter, giving up the right to update the fee even if provided in the agreement, including the retail trade index adjustments.

Registration of agreements

All the rental agreements of real properties must be registered, regardless of their amount and if in terms longer than 30 days a year. The agreement must be registered within 30 days from the date of stipulation, through telematic data comunication or by the Inland Revenue Office.

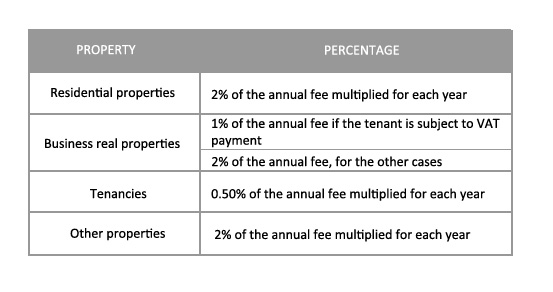

The registration fee is calculated on different percentages depending on the rented property, estimating a minimum payment of € 67.

Non-registration of the agreement, as well as the partial concealment of the consideration and the neglected or late payment of the stamp tax, will imply a fine.

Download the complete document "Guida per l'acquisto della Casa" of the Income Revenue Authority (updated to September 2022) - Italian only