Property taxation

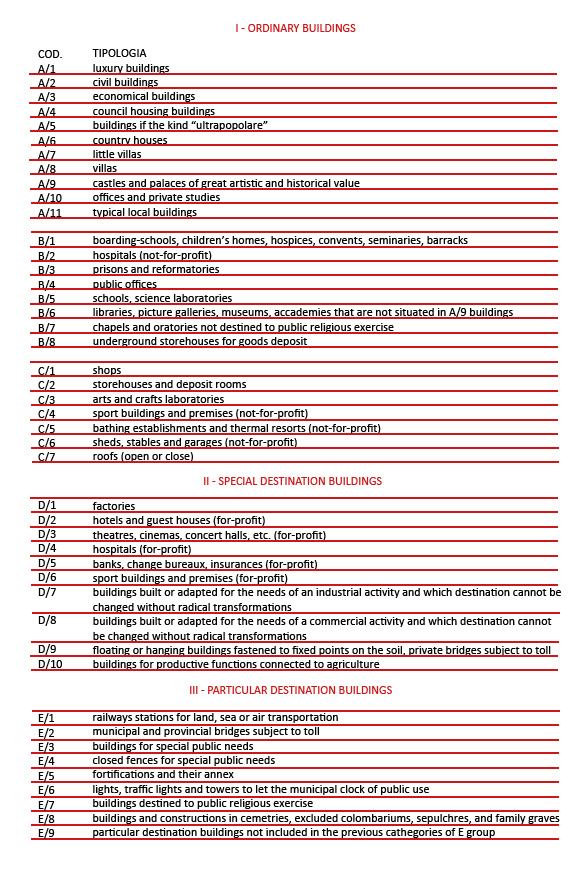

All properties are classified according to the land registry identification assigned by the provincial offices of the Regional Agency: each property, depending on its characteristics and its intended use, is assigned to a specific category and class.

The taxation and the land registry income of the property are closely linked to its classification. For ordinary buildings (that include homes, offices and stores) the land registry income is calculated by multiplying the size of the property (expressed in number of rooms, cubic meters and square meters) by the valuation rate of its class and category (published in the Official Journal).

The owners must report new constructions to the provincial Regional Agency within 30 days since they have become habitable or suitable for their intended use.

Personal income tax (Irpef)

The personal income tax is a tax that anyone who owns properties by way of ownership, usufruct or other legal claim must pay. From 1st January 2012, the income tax is not due on buildings subject to IMU (local housing tax), with the exception of leased properties.

Main house

In the case of a main house owned by way of life tenancy or other legal claim, you are entitled to a reduction equal to the amount of the land registry income of the property and relative outbuildings. Therefore we can say that the main house and outbuildings are exempt from the personal income tax. Such allowance shall also be entitled in case of usual residence of family members of the same taxpayer.

Properties kept available

For buildings used as accommodation owned in addition to the main house, the income is calculated by increasing of 1/3 the rate of the land registry income. Unless in case of free use by a family member that has his residence in the building.

Local housing tax (IMU)

The local housing tax (IMU) is a tax paid by all the owners of properties, whether they are owned by way of property or other legal claim (usufruct, use, residence, etc..), Including the first house and relative outbuildings.

How much IMU do I pay?

To calculate the IMU you must first identify your taxable base, and then apply on it the tax rate stated by law.

The taxable base is the value of the property, determined by the income into force at the beginning of the year with a 5% increase, multiplyed by the coefficients of the category and class assigned to the property by the land registry.

See the attached pdf at the bottom to find the coefficients (in Italian).

The tax rate of residential buildings is 0.86% and can be increased up to 1.6% by the Municipality or reduced to zero.

The first house and related appurtenances (C2, C6 and C7), no more than one of each type, are exempt from the IMU payment unless they are homes stacked in categories A / 1, A / 8 and A / 9.

In the latter case, the base rate is 0.5% with the possibility, for the Municipality, to increase it by 0.1% or reduce it to zero, and a deduction of € 200 is due.

When the tax must be paid

The IMU must be paid in 2 installments (respectively by June 16 and by December 16 in settlement of the tax due).

The IMU tax return

In general, the IMU tax return must be submitted when objective or subjective changes occur in the property, which the town council cannot directly detect.

The IMU tax return must be submitted by June 30 of the year following that in which ownership of the properties began or changes relevant to the determination of the tax have occurred.

For more details, please enquire at the appropriate town council office.

Download the complete document "Guida per l'Acquisto della Casa" of the Income Revenue Authority (updated to September 2022) - In Italian