Taxes on sale

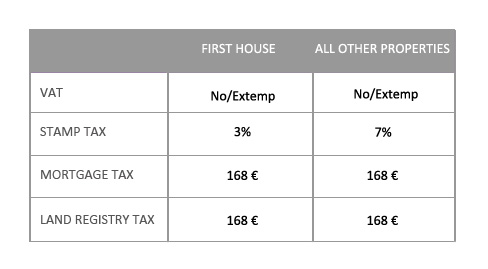

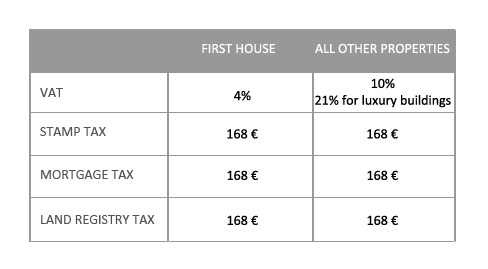

The buyer who purchases a building has to pay the VAT and/or the stamp tax and the mortgage and land registry taxes. The rates are lower in the case he is buying his first house. The tax amount depends on whether the seller is:

- A private or a non-construction company that did not carry out the reconstruction and redevelopment works, or the construction or redevelopment company that sells after 5 years from the date of the end of works:

- A construction or redevelopment company that sells within 5 years from the end of works or later, if within that period the property has been leased for a period of not less than 4 years in the implementation of subsidized housing programs

To prevent the sale of units that do not comply with the land registry rules and regulations, the buyer must indicate in the notarial act, under penalty of invalidity, in addition to the land registry data also the reference to the plans filed in the land registry.

Stamp, mortgage and land registry taxes are paid by the notary at the moment of the deed registration.

Necessary requirements to be entitled to the first house deductions:

- It should not be a luxury property

- The property must be located in the buyer’s town of residence (or where he will fix his residence within 18 months from the stipulation of the agreement.

In addition, the buyer must not be holder of rights of ownership, use, usufruct and habitation of other houses in that town and in the home territory.

Capital gains in case of property sale

From the sale of a property may result a capital gain as a difference between the purchase or construction price and the proceeds of the sale. This difference must be considered as income subject to taxation.

In place of the ordinary system of taxation, on the occasion of the sale the seller may ask the notary the application on the capital gain of a substitute tax of 20% that will be paid directly by the notary.

Download the complete document "Guida per l'acquisto della Casa" of the Income Revenue Authority (updated to September 2022) - Italian only